The Government of Canada recently announced some relief for Canadians to respond to the Covid-19 outbreak, including changes that impact payroll, employment insurance, and a small employer wage subsidy. Please see our comments below summarizing how these impact your business if you are needing to reduce your workforce and some key comments on the wage subsidy. If you have any questions about this information or any other measures released by the government please do not hesitate to contact us.

Preparing Employees’ Final Payments

The payment of an employee’s final payroll must include everything the employer owes an employee, including regular wages, overtime, statutory holiday pay, vacation pay still due and compensation for length of service (severance).

Final payment must be made:

- Within 48 hours after the last day an employee works when an employer ends employment

- Within six days after the employee’s last day of work when an employee quits

If an employee cannot be located, the employer must pay the wages to the Director of Employment Standards within 60 days of the wages being payable. The Director holds the wages in trust for the employee.

Preparing Record of Employment (“ROE”) Forms

If an employee’s employment is terminated, including if your employees are directly affected by the coronavirus (COVID‐19), and they are no longer working, you must issue an ROE.

Most common situations:

- When the employee is sick or quarantined, use code D (Illness or injury) as the reason for separation (block 16 on the ROE). Do not add comments.

- When the employee is no longer working due to a shortage of work because the business has closed or decreased operations due to coronavirus (COVID‐19), use code A (Shortage of work). Do not add comments.

- When the employee refuses to come to work but is not sick or quarantined, use code E (Quit) or code N (Leave of absence), as appropriate.

Avoid adding comments unless necessary.

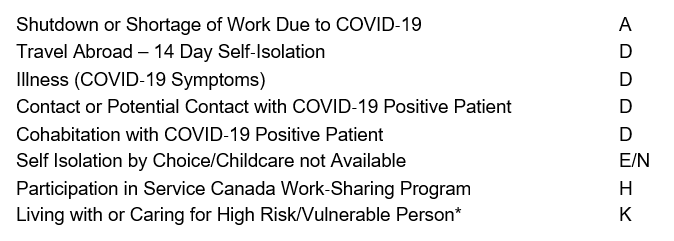

An extended list of reasons and codes for Termination:

*Code K – Use Code K only in exceptional circumstances not covered by other ROE Codes (provide an explanation in Block 18, Comments).

Also, in Block 16, you must enter the full name and telephone number of the person in your organization who is readily available to provide more information or clarification about the reason for issuing the ROE.

Helping Your Employees Apply for Employment Insurance Benefits

If your employees are applying for EI with Service Canada, here are some tips you can share with them:

- You should apply as soon as possible after you stop working. People who cannot complete their claim for EI sickness benefits due to quarantine may apply later and have their EI claim backdated to cover the period of delay.

- The one-week waiting period for EI sickness benefits is waived for new claimants who are quarantined so they can be paid for the first week of their claim. People claiming EI sickness benefits due to quarantine will not have to provide a medical certificate.

- Apply online instead of at a Service Canada office. If you go to a Service Canada office, please note that measures are in place relating to the COVID-19 virus and everyone is required to respect social distancing. If you are able to access the service you require online or by mail, you will be asked to return home to do so.

- Since Service Canada has received an extremely high number of applications for employment insurance, applicants may experience a slow loading time with the Service Canada website as thousands of others are trying to process their claim as well. Do not refresh the page at any point in time as it may require a restart of the application.

- Before starting the EI application, review eligibility requirements and make sure that all required personal information is available.

- Early in the online application process, the applicant will receive a temporary password. This should be saved somewhere safe in case the online application is lost. This will allow the applicant to revisit where they last left off.

- The federal aid package also includes the Emergency Care Benefit and the Emergency Support Benefit for those who would otherwise not qualify for the EI Benefit. Both benefit plans will be available to apply for in April, through the CRA website, and a toll-free number that has not yet been issued.

Please do not hesitate to contact us if you have any questions regarding the above.

Regards,

A-R PARTNERS